Trump’s double-whammy to US assets sends investors toward short-term bonds

(Originally published March 24 in “What in the World“) It’s no secret that Trump’s policies have managed to torpedo both the stock market and the U.S. dollar.

What may come as news, though, is just how exceptionally rare it is for this to happen: that investors decide U.S economic prospects have slammed so far into reverse that they’d rather put their money anywhere but into U.S. assets. According to Goldman Sachs, investors’ faith in “American exceptionalism” has faltered only a handful of times in the past generation.

And it isn’t just that U.S. President Donald Trump’s schizophrenic policymaking, federal layoffs, and tariffs, have put U.S. prospects behind those of other economies and raised the prospects of stagflation. It’s that he’s managed to galvanize economies until very recently thought to be facing their own inexorable decline, such as China and Europe. The result, to borrow from the Black Eyed Peas: foreign assets are so 3008. U.S. assets are so 2000 and late.”

While the S&P500 has dropped almost 5.5% since Trump’s inauguration, the MSCI World index—which includes the U.S.—has fallen only 2.3%. The dollar index has fallen almost 5%.

For his next trick, Trump aims to up-end the U.S. housing market, a bulwark of American household wealth. Trump’s head of the Federal Housing Finance Agency, William Pulte, has fired more than a dozen board members at Fannie Mae and Freddie Mac and appointed himself chairman of both. Trump’s aim is to privatize the two mortgage agencies, which subsidize credit to the U.S. housing sector by buying mortgages from banks, securitizing them, and selling off the resulting bonds to investors.

And in case you still think that Trump is relying on some clear-eyed master plan (like Stephen Miran’s) that lends method to this madness, think again. As Nobel Prize-winning economist Paul Krugman puts it, the White House is leaning on this plan like a drunkard on a lamppost: for support, not illumination.

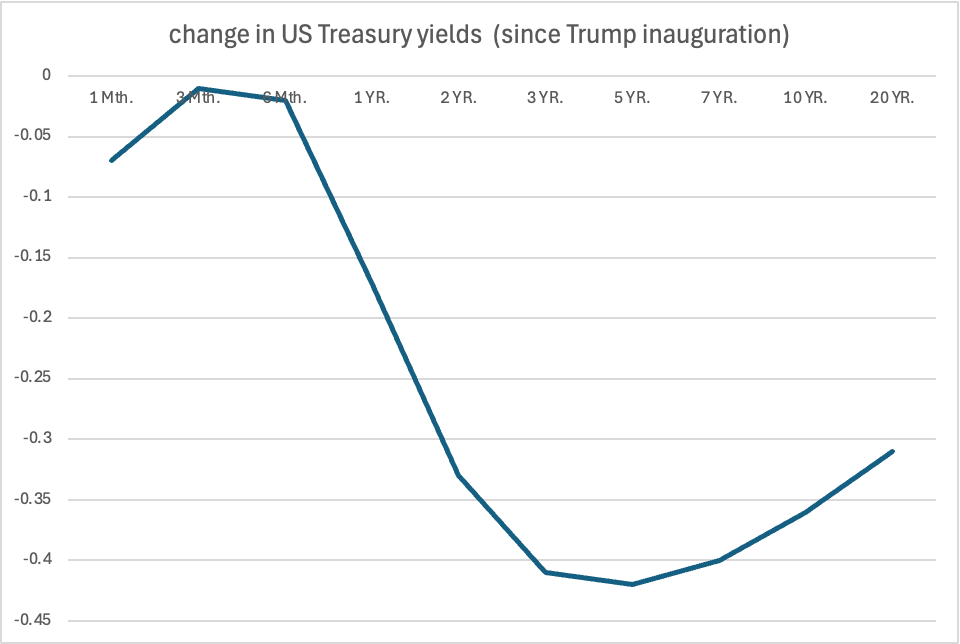

Investors are fleeing to cash and the safety of bonds. But not just any bonds: they’re increasingly favoring short-term debt. According to the Financial Times, $21.7 billion flowed into short-dated Treasury funds between early January and March 14, while only $2.6 billion flowed into long-term Treasury funds.

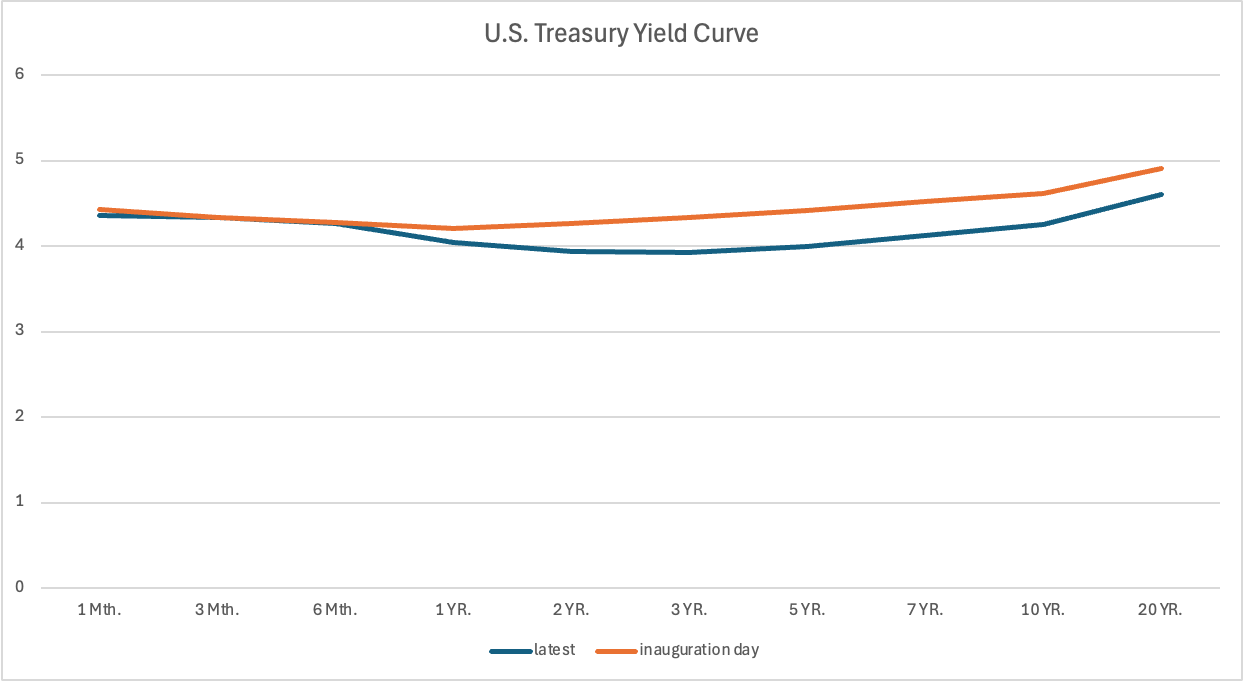

This flight to safety is evident in the bull flattener taking place in the Treasury market. Long-term rates have been falling, which Trump and his Treasury Secretary have wanted, but they’re falling faster than short-term rates, resulting in an inverted curve in the 2- to 5-year portion of the curve. Despite the name, a bull flattener usually coincides with expectations of recession.