Trump keeps shrugging off the market’s screams of horror

(Originally published March 12 in “What in the World“) The U.S. Education Dept. will lay off 1,300 employees, leaving it with half the workforce it had before Trump took office.

But the job is only half done: Trump is still planning to abolish the entire education department. Stocks whipsawed, not out of fears for the future of the American intellect, though that is certainly endangered. No, stocks were sent into a fresh decline after Trump announced he was doubling tariffs on imports of Canadian aluminum and steel. Stocks rebounded slightly when Trump reversed course after Ontario suspended a provincial surtax on power exports to the U.S. The benchmark S&P500 has fallen almost 8% since Trump’s inauguration.

Trump’s response to the market’s ructions so far: So what? He once seemed singularly concerned with the market as the best rating of his performance, giving rise to what investors dubbed a “Trump put”—if the market tumbled, he would desist. No more. He now seems convinced he must ignore the market’s cries and break things to “save” the economy. Economists say he is more likely crashing it, with a recession likely and tariffs wreaking long-term economic damage.

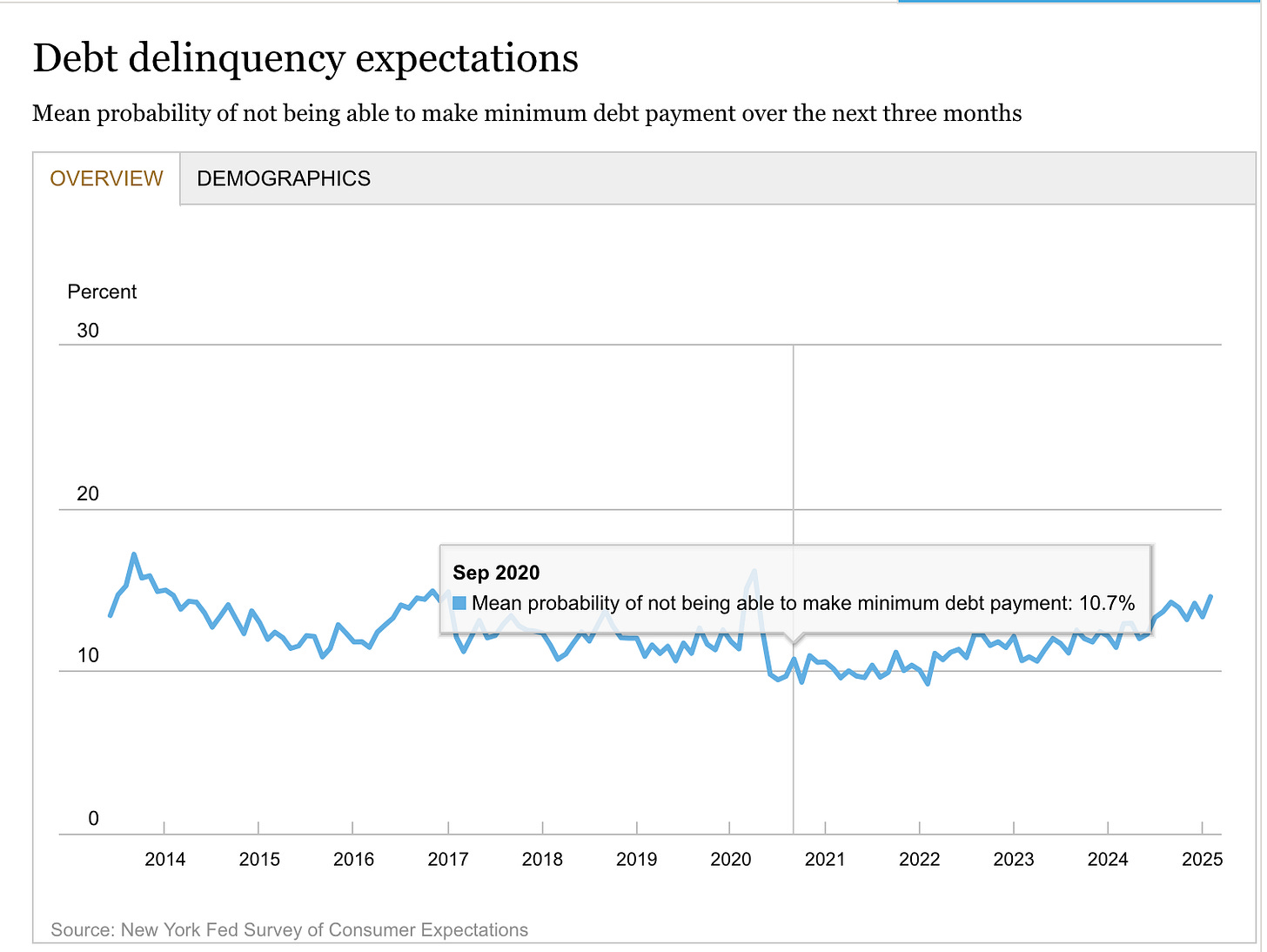

Uncertainty among small businesses is rising. So is concern about consumers. U.S. household credit-card debt crept above $10,000 last year for the first time since 2009, according statistics cited by The Wall Street Journal. Consumers are more pessimistic about their household finances than they’ve been since November 2023.

And as laid out last week, Trump’s support of cryptocurrencies, his advisers’ call to up-end the strong-dollar policy and replace it with capital controls, as well as his moves to gain control over independent federal agencies such as the Federal Reserve, are undermining the U.S. dollar’s role as the global reserve currency.

Trump’s nonchalance about the destruction of his constituents’ wealth resembles not so much his Russian authoritarian counterpart, Vladimir Putin, but China’s President Xi Jinping. It was Xi who, in the summer of 2023, terrified markets when investors realized he was less concerned about short-term economic pain and the market turmoil it was causing than with achieving his own, long-term policy goals.