Worsening job market buoys markets praying the Fed will give in to Trump

(Originally published Sept. 4 in “What in the World“) The U.S. job market appears to be darkening—so good news for markets.

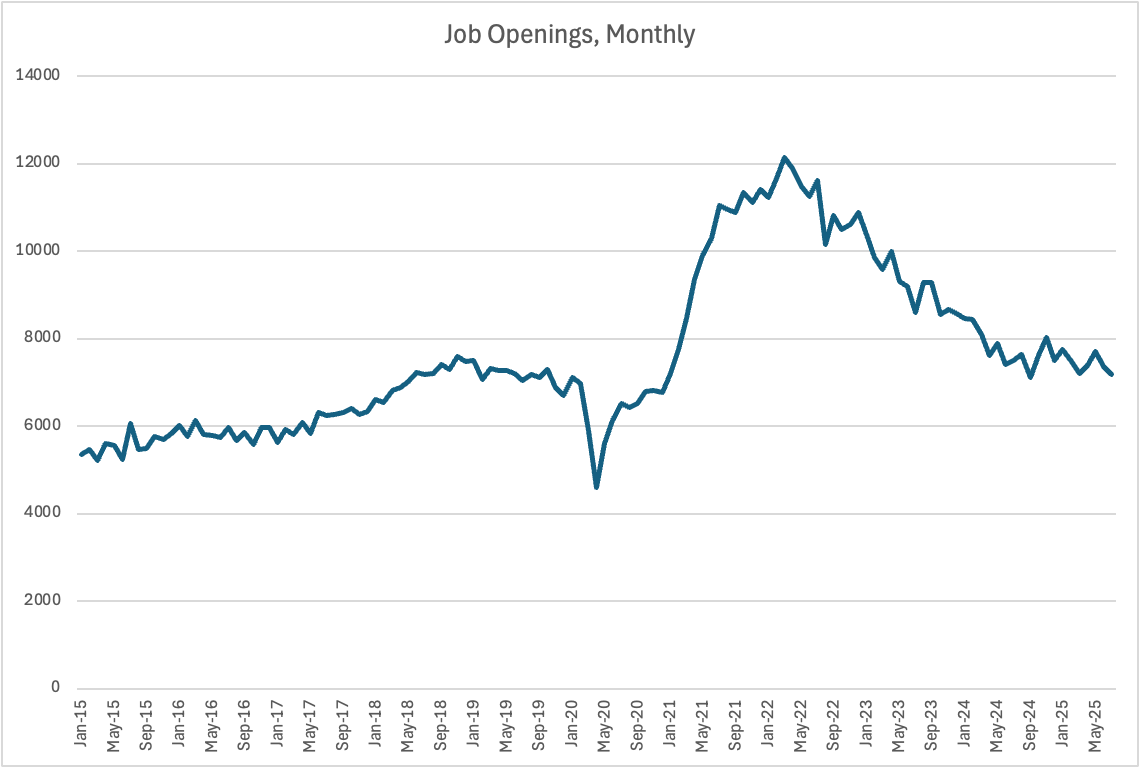

New job openings in July fell 4% from the same month a year ago, according to the latest data from the U.S. Bureau of Labor Statistics, their lowest in 10 months. On a quarterly basis, job openings fell 2.5% in the three months ended July 31 from the same period of 2024.

Markets interpreted that as further evidence that the U.S. Federal Reserve will likely cut its benchmark interest rate this month.

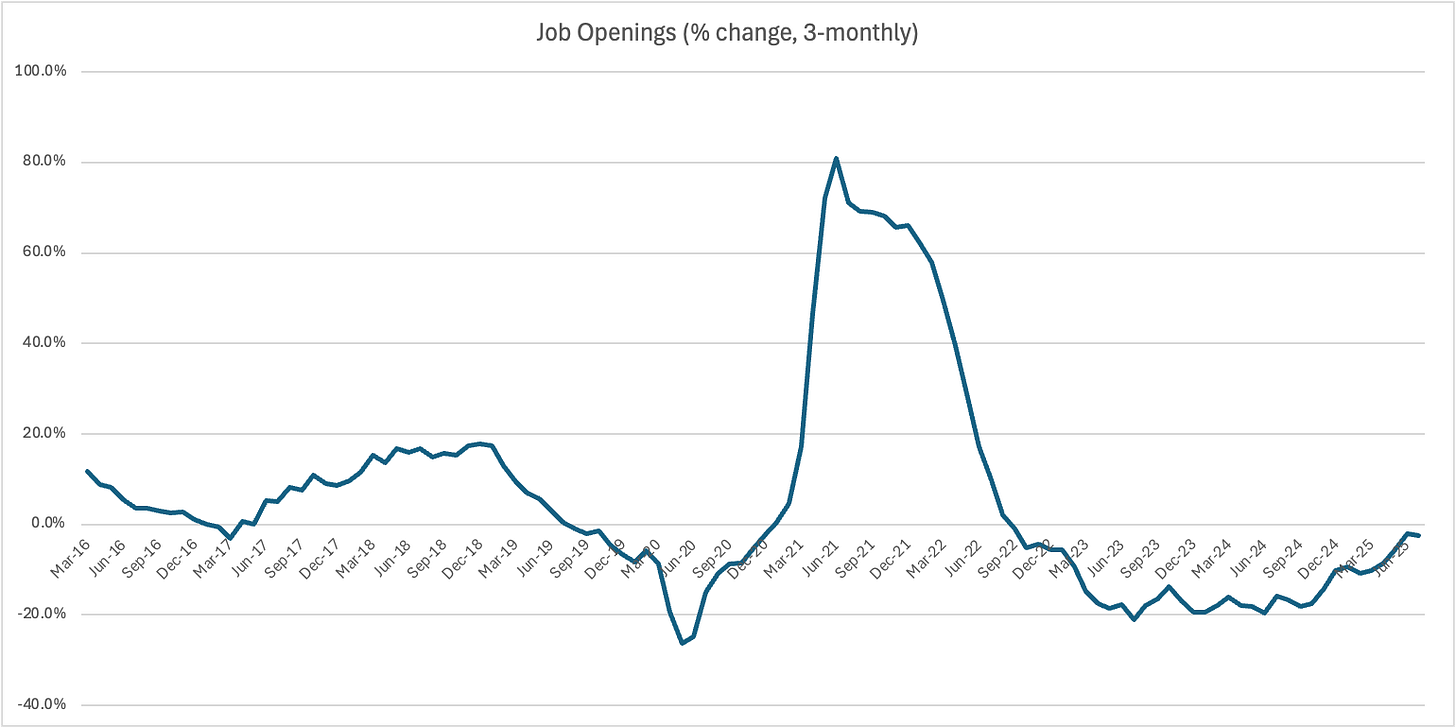

In fact, the data suggest the job market is finally recovering from the surge in hiring that followed the end of the pandemic. Job openings rocketed upward in early 2021 and continued to expand until three years ago, when they fell into a correction that now appears on the verge of ending. Unless, that is, the combination of uncertainty over Trump’s trade policies and AI trigger a new jobs recession.

Either way, the most worrying aspect of the job openings data isn’t the lack of growth, but the number of openings to the number of jobless Americans. While that number has been greater than 1 since the post-pandemic surge, in July it fell to 0.99, the first time in four years that there have been fewer jobs available than the number of unemployed. That suggests the economy has moved from a surplus of jobs and rising wages, to a surplus of labor and falling wages—and that boosts the case for the Fed to cut rates. So, bad news for the economy; good news for markets.