Choosing jobs over inflation, Fed avoids conflict and surrenders to Trump

(Originally published Sept. 18 in “What in the World“) The Fed did not disappoint.

The U.S. Federal Reserve cut its benchmark interest rate yesterday by 0.25 percentage points, to between 4% and 4.25%, in response to a weakening U.S. economy.

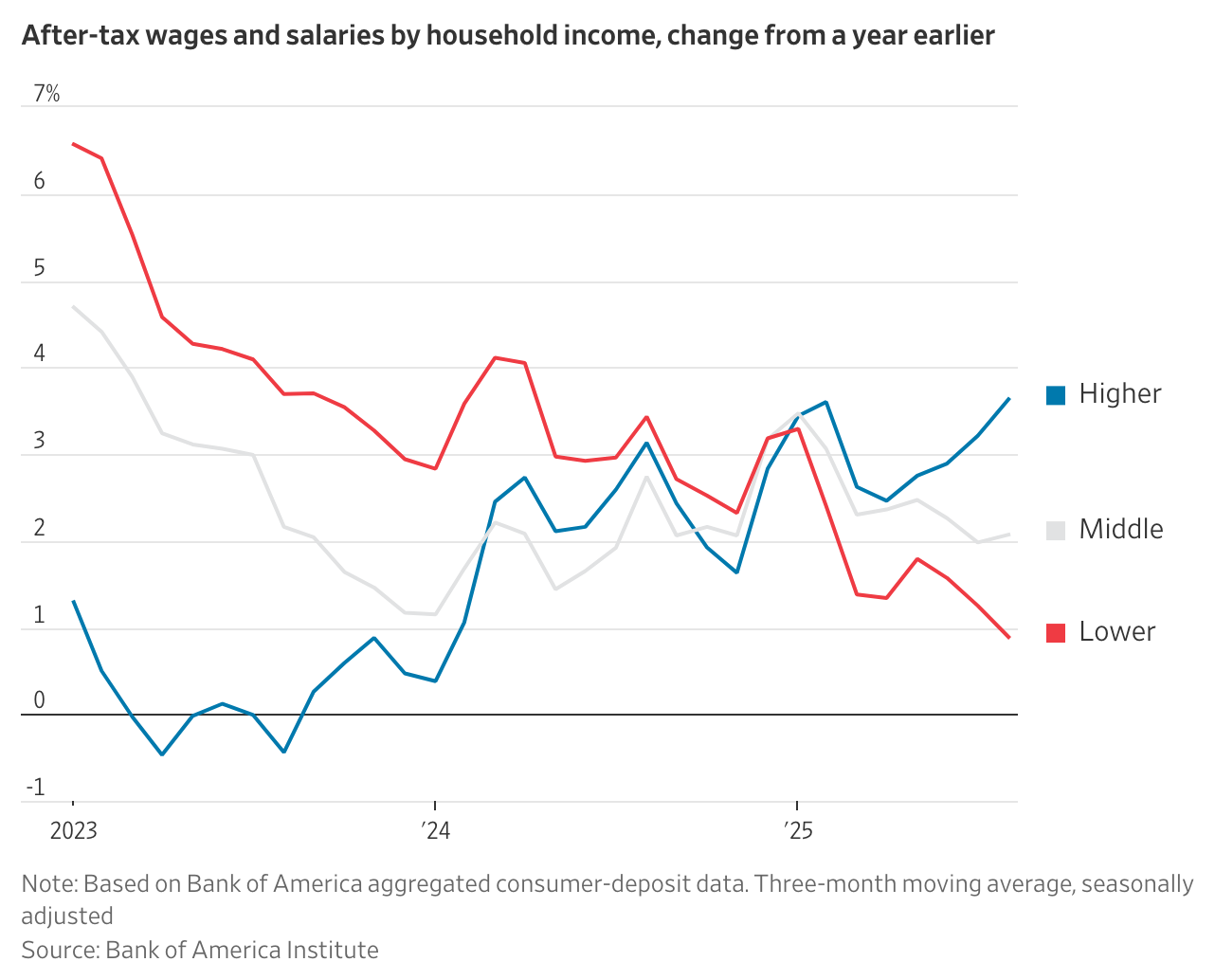

The Fed is right to worry: while rising stock prices are keeping older savers and wealthy Americans in the pink, younger people with less savings face a weak job market and slowing wage growth and so are cutting back on spending. Even wealthier Americans, who have been propping up consumer spending, are showing signs they, too, may be pulling back.

So the Fed is now clearly more concerned about rising joblessness than about persistent inflation. The Federal Open Market Committee voted to cut rates and predicted two more cuts by year-end and another next year. Yet it also predicted that inflation won’t drop to the Fed’s 2% target until at least 2028.

Source: The Wall Street Journal

With lower rates on deposits to lure them, investors have renewed their retreat from America’s currency. The U.S. dollar fell Tuesday, with the dollar index dropping to its lowest since February 2022, before recovering some ground Wednesday. Investors are at least 80% sure the Fed will make good on its predicted two, quarter-point cuts before the end of year as the economy cools. That spells lower profits on U.S. investments, and a lower rate on U.S. dollar deposits. So, investors have renewed their shift out of the growing uncertainty around U.S. assets in favor of gold and foreign assets.

Investors also appear to be hedging against a loss of Fed independence, as Trump’s economic adviser Stephen Miran joins its board of governors and, in doing so, the FOMC. The U.S. Senate confirmed Miran this week in time for him to vote on the latest rate decision; Miran voted for an even larger cut. Trump is still trying to fire Fed governor Lisa Cook, and next year may have an opportunity next February to pressure regional Federal Reserve banks to appoint committee representatives more agreeable to his demands to cut rates further even as he maintains the U.S. economy remains strong.