Contagion hits markets as recession fears grow over Trump tariff miscalculations

(Originally published April 7 in “What in the World“) Stocks are poised to keep sliding in response to Trump’s tariffs, which it turns out are based on a bogus formula—and bad math, too.

Economists at the American Enterprise Institute, a conservative Washington think tank, checked the numbers the Trump administration plugged into their cockamamie formula for setting reciprocal tariffs and discovered their math is bad. Even the Harvard professor whose research they cited to come up with it says they got it wrong.

The result: Trump’s tariffs are roughly four times higher than they would be if they correctly used the formula. Which is fundamentally stupid in the first place.

The impact has already proved disastrous. Federal Reserve Chairman Jerome Powell said Friday stagflation risks had risen. “While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected,” he said. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth. Goldman Sachs has raised its estimate of the odds of a U.S. recession in the next 12 months to 45% from 35%. JPMorgan has raised its estimate of the likelihood of a global recession to 60% from 40%. Billionaire investor Bill Ackman posted on X that if Trump doesn’t pause the tariffs, “we are heading for a self-induced, economic nuclear winter, and we should start hunkering down.”

Trump and his advisers remained defiant, with Trump telling reporters as he returned to the White House from playing golf in Florida: “Sometimes you have to take medicine to fix something.” On Truth Social, meanwhile, he posted: “HANG TOUGH, it won’t be easy, but the end result will be historic.”

Trump seems destined to be right on that point, at least. Increasingly fearful U.S. investors are cashing out of stocks, sapping liquidity from the market, and are dumping junk bonds at the fastest pace since the pandemic in 2020. The drastic declines in stocks have prompted margin calls that are forcing leveraged investors to liquidate other assets for collateral and thereby spreading turmoil into assets previously considered relative “safe havens:” oil, copper, gold, cryptocurrencies and the dollar.

U.S. consumers are bracing for higher prices and fewer choices. U.S. farmers are bracing for billions of dollars in lost exports after Beijing imposed a 34% retaliatory tariff against Trump’s new 34% tariff on China. And the very manufacturers Trump hopes will boost production and hiring as tariffs kill competition from foreign imports are now paralyzed by soaring costs for imported materials and equipment they can’t expand without.

Worse, Trump has touched off a global rejection of the rules-based international order created under Washington’s leadership after the Second World War. That geopolitical order, which governed both finance and security, held benefits both explicit and implicit for the U.S., not least of which was its ability to maintain a dominant global military presence and sell weapons to its allies, but also to impose the U.S. dollar as the world’s reserve currency and leading medium of exchange. Whatever world emerges from Trump’s autarky, it is unlikely to favor such a heavy reliance on U.S. leadership.

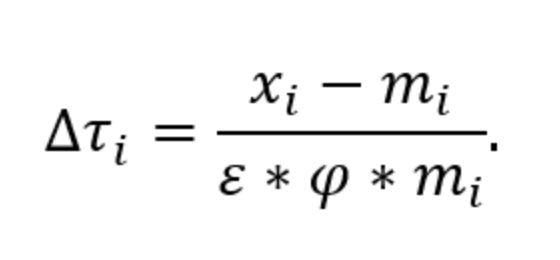

Regular readers will recall that the Office of the U.S. Trade Representative cited the fancy-looking formula below to calculate the new tariffs:

Where:

xi = total exports from the U.S. to a trading partner;

mi = total imports from that country to the U.S., which yields the trade deficit as the numerator;

ε = “the elasticity of imports with respect to import prices;” and

φ = “the passthrough from tariffs to import prices,” to yield

τi = the additional tariff the U.S. imposes to redress a trade deficit.

Underlying it is the erroneous assumption that bilateral trade should be in balance, which is utter nonsense. The outcome of this equation, particularly with less-developed nations such as Cambodia that can’t afford expensive U.S. products but can more cheaply produce low-end goods for rich Americans, isn’t balanced trade. The outcome is no trade at all. Worse, Trump imposed a minimum 10% tariff on all countries, meaning even if the U.S. has no deficit with a particular country—or even runs a surplus—Trump slapped at least a 10% tariff on imports from that country. That’s how the penguins of Heard Island and McDonald Islands ended up being hit with 10% tariff.

AEI’s economists say the Trump’s Council of Economic Advisers, headed by the author of Trump’s wrongheaded trade strategy Stephen Miran, goofed up its calculation of the formula. They say Miran & Co. plugged in the wrong number for the elasticity of import prices, using retail prices to calculate φ instead of import prices. That gave them a value of 0.25, which when multiplied by ε, which is 4, yields 1. That meant that the two variables ε and φ effectively cancelled each other out and the formula ended up dividing the trade deficit by total imports.

What they should have used for the elasticity of import prices, AEI says, is 0.945, which multiplied by 4 yields 3.78,* resulting in a much larger denominator and, thus, a much lower final tariff. They conclude that Trump’s tariffs are thus four times higher than they should be using this formula, which is inappropriate anyway. Adjusted to correct the error, Trump’s tariff on Cambodia should be 13% rather than 49%, Vietnam’s should be 12.2% instead of 46%, and so on.

AEI’s corrections don’t include the fact that the Trump administration also used only figures for trade in manufactured goods, omitting services in which the U.S. runs a nearly $300 billion trade surplus with the rest of the world. Adding those would likely reduce the trade imbalance in the numerator of the tariff equation, resulting in an even lower tariff figure.

Trump’s tariffs are also upending efforts to battle climate change, raising the cost for clean energy projects, as former Wall Street Journal reporter and Cipher energy correspondent Bill Spindle explains in his own newsletter:

“U.S. solar projects will struggle to obtain solar modules after Trump topped Biden administration tariffs on Vietnam, a leading module manufacturing hub. Critical mineral supply chains that undergird the global market for batteries will be disrupted… …Under a tariff-happy Trump administration, ‘energy dominance’ for the U.S. is coming to mean inward-looking, fossil fuel-based independence. That may feel reassuring to isolationists, but it’s a recipe for lagging in global manufacturing, not surging ahead.”